Aerospace And Defense Ducting Market In 2029

The Business Research Company's Aerospace And Defense Ducting Market In 2029

LONDON, GREATER LONDON, UNITED KINGDOM, December 3, 2025 /EINPresswire.com/ -- "Get 20% Off All Global Market Reports With Code ONLINE20 – Stay Ahead Of Trade Shifts, Macroeconomic Trends, And Industry Disruptors

Aerospace And Defense Ducting Market to Surpass $7 billion in 2029. In comparison, the aerospace and defense components market, which is considered as its parent market, is expected to be approximately $104 billion by 2029, with aerospace and defense ducting to represent around 6.8% of the parent market. Within the broader aerospace and defense industry, which is expected to be $1,102 billion by 2029, the aerospace and defense ducting market is estimated to account for nearly 0.6% of the total market value.

Which Will Be the Biggest Region in the Aerospace And Defense Ducting Market in 2029?

North America will be the largest region in the aerospace and defense ducting market in 2029, valued at $2,744 million. The market is expected to grow from $2,173 million in 2024 at a compound annual growth rate (CAGR) of 5%. The steady growth can be attributed to the rising defense spending and growth in aircraft production.

Which Will Be The Largest Country In The Global Aerospace And Defense Ducting Market In 2029?

The USA will be the largest country in the aerospace and defense ducting market in 2029, valued at $2,362 million. The market is expected to grow from $1,915 million in 2024 at a compound annual growth rate (CAGR) of 4%. The steady growth can be attributed to the rising defense spending and growth in aircraft production.

Request a free sample of the Aerospace And Defense Ducting Market report:

https://www.thebusinessresearchcompany.com/sample_request?id=9849&type=smp

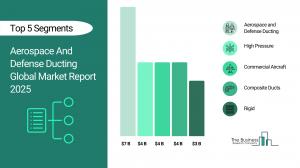

What will be Largest Segment in the Aerospace And Defense Ducting Market in 2029?

The aerospace and defense ducting market is segmented by duct type into rigid, semi-rigid and flexible. The rigid market will be the largest segment of the aerospace and defense ducting market segmented by duct type, accounting for 46% or $3,201 million of the total in 2029. The rigid market will be supported by high structural strength and dimensional stability for long service life, strong suitability for high-temperature and high-vibration environments, proven compatibility with precision HVAC and fluid-handling systems, low leakage rates that improve system efficiency, wide acceptance in certified aircraft platforms and retrofit programs, and established manufacturing and inspection processes that simplify certification.

The aerospace and defense ducting market is segmented by material into titanium ducts, stainless steel ducts, nickel alloy ducts, composite ducts and other materials. The composite ducts market will be the largest segment of the aerospace and defense ducting market segmented by material, accounting for 51% or $3,583 million of the total in 2029. The composite ducts market will be supported by very low weight compared with metals improving fuel economy, corrosion-free operation reducing maintenance, design flexibility enabling complex cross-sections and integrated features, good vibration damping and thermal insulation characteristics, and increasing acceptance due to advances in composite manufacturing and repair techniques.

The aerospace and defense ducting market is segmented by application into commercial aircraft, regional aircraft, general aviation, helicopter and military aircraft. The commercial aircraft market will be the largest segment of the aerospace and defense ducting market segmented by application, accounting for 51% or $3,615 million of the total in 2029. The commercial aircraft market will be supported by large fleet sizes creating steady aftermarket demand, strict fuel-efficiency targets that incentivize lighter ducting solutions, long-term OEM and supplier contracts that stabilize volumes, regulatory certification pathways well-established for proven materials, and modernization programs (retrofits, cabin refurbishments) that create recurring opportunities.

The aerospace and defense ducting market is segmented by pressure into high pressure and low pressure. The high pressure market will be the largest segment of the aerospace and defense ducting market segmented by pressure, accounting for 62% or $4,346 million of the total in 2029. The high pressure market will be supported by demand from bleed-air, hydraulic, and pressurization systems requiring robust containment, stringent regulatory and safety standards that favor qualified ducting solutions, advanced sealing and joint technologies that maintain integrity under load, materials and designs capable of withstanding cyclical pressure loading, and lifecycle testing regimes that validate performance for mission-critical applications.

What is the expected CAGR for the Aerospace And Defense Ducting Market leading up to 2029?

The expected CAGR for the aerospace and defense ducting Market leading up to 2029 is 5%.

What Will Be The Growth Driving Factors In The Global Aerospace And Defense Ducting Market In The Forecast Period?

The rapid growth of the global aerospace and defense ducting market leading up to 2029 will be driven by the following key factors that are expected to reshape aircraft systems design, manufacturing, maintenance and supply-chain practices worldwide.

Growth in Aircraft Production - The growth in aircraft production will become a key driver of growth in the aerospace and defense ducting market by 2029. Modern aircraft demand complex ducting systems for environmental control, fuel delivery, hydraulics, and pneumatics. Rising global air travel, airline fleet expansions, and increasing aircraft orders—especially from emerging markets—are contributing to higher production volumes of both narrow-body and wide-body aircraft. This surge in output directly boosts demand for lightweight, heat-resistant, and high-efficiency ducting components that support improved fuel economy and system reliability. Furthermore, next-generation aircraft designs, which prioritize aerodynamics and sustainability, require custom ducting solutions that integrate advanced materials and fit within compact, streamlined airframes. As major manufacturers ramp up production and streamline supply chains to fulfill global demand, the aerospace and defense ducting market is set to grow in tandem with these expanding operations. As a result, the growth in aircraft production is anticipated to contributing to a 1.5% annual growth in the market.

Rising Defense Spending - The rising defense spending will emerge as a major factor driving the expansion of the market by 2029. Increased military budgets support the acquisition of new aircraft, helicopters, and unmanned aerial systems, all of which rely on advanced ducting systems for functions such as cooling, ventilation, and hydraulics. Additionally, higher defense allocations fuel extensive maintenance, repair, and overhaul (MRO) operations, where ducting components often require replacement or upgrading due to wear, corrosion, or the need for improved performance. The focus on enhancing mission readiness, system durability, and operational efficiency further accelerates the adoption of high-performance ducting solutions made from advanced materials like composites and alloys. As global defense programs expand, manufacturers of aerospace ducting systems are poised to benefit from sustained demand for precision-engineered ducts capable of withstanding the extreme conditions typical of military applications. Consequently, the rising defense spending is projected to contributing to a 1.2% annual growth in the market.

Rising Demand for Lightweight and Corrosion-Resistant Materials - The rising demand for lightweight and corrosion-resistant materials will serve as a key growth catalyst for the market by 2029. Advanced composites, titanium, and nickel alloys are increasingly favored for ducting systems due to their excellent strength-to-weight ratios, durability in extreme environments, and extended service life compared to conventional materials. The shift toward lighter materials supports aircraft weight reduction, enhances fuel efficiency, and helps lower emissions—key objectives in the industry's push for greater sustainability. As aerospace OEMs and MRO providers increasingly prioritize materials that combine mechanical strength with resistance to environmental degradation, the need for high-performance ducting solutions is accelerating, underscoring their essential role in both current and next-generation aircraft platforms. Therefore, this rising demand for lightweight and corrosion-resistant materials is projected to supporting to a 0.8% annual growth in the market.

Rising Investments in Urban Air Mobility (UAM) and eVTOL Aircraft - The rising investments in urban air mobility (UAM) and eVTOL aircraft will become a significant driver contributing to the growth of the market by 2029 As governments and private companies push for sustainable, electric-powered aerial transportation solutions for urban environments, the demand for compact, lightweight, and thermally efficient ducting systems is rising. eVTOL and UAM aircraft require advanced ducting to manage temperature, distribute air, and reduce noise within tightly packed cabin and propulsion systems. This emerging sector calls for innovative ducting materials and designs capable of operating efficiently within electric propulsion architectures and constrained airframe spaces. Additionally, increased funding and rapid prototype development are pushing ducting manufacturers to evolve their technologies to meet high electrical safety standards, enable modular integration, and achieve significant weight reductions—key factors driving demand as UAM and eVTOL platforms edge closer to commercial deployment. Consequently, the rising investments in urban air mobility (UAM) and eVTOL aircraft is projected to contributing to a 0.5% annual growth in the market.

Access the detailed Aerospace And Defense Ducting Market report here:

https://www.thebusinessresearchcompany.com/report/aerospace-and-defense-ducting-global-market-report

What Are The Key Growth Opportunities In The Aerospace And Defense Ducting Market in 2029?

The most significant growth opportunities are anticipated in the rigid aerospace and defense ducting market, aerospace and defense composite ducting market, commercial aircraft ducting market and high pressure aerospace and defense ducting market. Collectively, these segments are projected to contribute over $3 billion in market value by 2029, driven by advances in lightweight composite materials, automation in production systems, and increasing demand for fuel-efficient and next-generation aircraft. This surge reflects the accelerating modernization of aerospace and defense manufacturing, emphasizing thermal efficiency, vibration resistance, and structural integrity, fueling transformative growth within the broader aerospace and defense components industry.

The high pressure aerospace and defense ducting market by $1,021 million, the aerospace and defense composite ducting market by $894 million, commercial aircraft ducting market by $784 million, and the rigid aerospace and defense ducting market is projected to grow by $647 million over the next five years from 2024 to 2029.

Learn More About The Business Research Company

The Business Research Company (www.thebusinessresearchcompany.com) is a leading market intelligence firm renowned for its expertise in company, market, and consumer research. We have published over 17,500 reports across 27 industries and 60+ geographies. Our research is powered by 1,500,000 datasets, extensive secondary research, and exclusive insights from interviews with industry leaders.

We provide continuous and custom research services, offering a range of specialized packages tailored to your needs, including Market Entry Research Package, Competitor Tracking Package, Supplier & Distributor Package and much more.

Disclaimer: Please note that the findings, conclusions and recommendations that TBRC Business Research Pvt Ltd delivers are based on information gathered in good faith from both primary and secondary sources, whose accuracy we are not always in a position to guarantee. As such TBRC Business Research Pvt Ltd can accept no liability whatever for actions taken based on any information that may subsequently prove to be incorrect. Analysis and findings included in TBRC reports and presentations are our estimates, opinions and are not intended as statements of fact or investment guidance.

Contact Us:

The Business Research Company

Americas +1 310-496-7795

Europe +44 7882 955267

Asia & Others +44 7882 955267 & +91 8897263534

Email: info@tbrc.info

Follow Us On:

LinkedIn: https://in.linkedin.com/company/the-business-research-company"

Oliver Guirdham

The Business Research Company

+44 7882 955267

info@tbrc.info

Visit us on social media:

LinkedIn

Facebook

X

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.